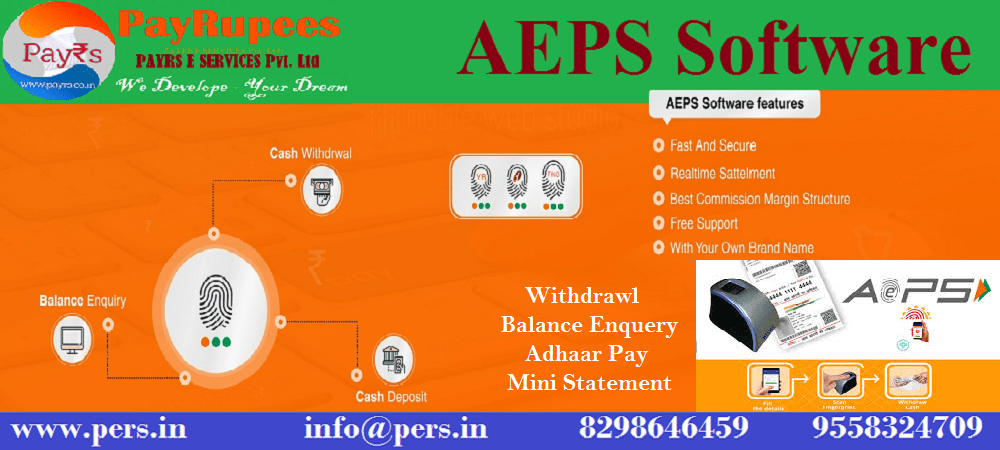

AEPS Software Features

- Cash Withdrawal.

- Balance Check.

- Supports All Banks.

- Mini Statement.

- Instant Settlement.

- Highest Commission.

- Safe Aadhar to Aadhar Fund Transfer.

- Easy , Safe and Secure System.

- Unlimited Master Distributors Creation.

- Unlimited Distributors Creation.

- Unlimited Retailer Creation.

- Support Ticket Option.

- Set commission According to You.

- Maximum Transaction Limit.

- Payment Transaction.

- 24/7 support.

Apply For AEPS Software

The Aadhaar Enabled Payment System (AePS) is a bank-led model developed by NPCI, which allows online transactions at Micro ATM/Kiosk/mobile devices through the authorised Business Correspondent (BC) of any bank using Aadhaar authentication.

Best AEPS Software Provider with Great Features

AEPS Software Features

- Cash Withdrawal.

- Balance Check.

- Supports All Banks.

- Mini Statement.

- Instant Settlement.

- Highest Commission.

- Safe Aadhar to Aadhar Fund Transfer.

- Easy , Safe and Secure System.

- Unlimited Master Distributors Creation.

- Unlimited Distributors Creation.

- Unlimited Retailer Creation.

- Support Ticket Option.

- Set commission According to You.

- Maximum Transaction Limit.

- Payment Transaction.

- 24/7 support.

We are best AEPS Software developer Company in India, we also develope Recharge Portal, MLM Software, B2B Software,

AEPS Software Featues

Cash Withdrawal

Using AEPS service, all your business partners can start cash withdrawal facility on own retail shop to their walk in customers. Any customer can withdraw cash from his/her bank account without going to the bank. Just go to any of the Retail shop and withdraw the required amount of cash by just providing your Aadhaar number, bank name and thumb/finger impression. In AEPS you have to use aadhaar card to withdrawal money while in mPOS machine you can withdrwal money using credit or debit card. We also provide you mATM integrated with mPOS software.

- Cash Deposit

At retail shop, customer can use AEPS for depositing cash and require aadhaar number, bank name, and thumb/finger impression. It is easy to access at anytime.

- Balance Enquiry

At retail shop walk in customer can check his/her bank account balance. For banking transaction require customers Aadhaar details, bank name and fingerprint, after that his/her can check bank balance detail on the screen.

- Fund Transfer

Using AEPS service customer can send money instantly to any bank account through Aadhaar Verification, Aadhar must be link with bank account to use AEPS service.

In AEPS service, the fingerprint is authenticated by the UIDAI. In response to a transaction, UIDAI tells to the bank about the authenticity of the user. Once, UIDAI authenticates, the bank gives green signal to the transaction. For more detail about AEPS service, please send your query Here You can offer multiple services using Ezulix portal. Along with AEPS, you can also offers bill payment services to your customers by integrating bharat bill payment system in your portal.

Mini Statement

Deposit

Money Transfer

Pay Out

Adhaar Pay

For More detail Contact 9558324709

Quick Settlements

Realtime Settlement for All Channels.

Agent Onboarding

Realtime agent onboarding with Ekyc enable to your agent Realtime transactions facility.

Trust and Reliability

12 Years of truthfulness and experience.

AEPS Software Development Company

PayRs E Services Private Limited is the Leading AEPS Software Provider and Multi Recharge Portal Development Company. We are the best B2B AEPS Software & All in One Recharge Software Development API Services provider. Contact Us

AEPS Software Provider

This solution has been designed by NPCI to handle various kinds of service requests effectively by enabling an authentication gateway for all Aadhaar linked account holders. Any resident of India having an Aadhaar number linked to a bank account – referred to as an Aadhaar Enabled Bank Account (AEBA) – can utilise the AePS service.

AADHAAR Enabled Payment System is a payment service empowering a bank customer to use basic financial services (cash deposit, balance enquiry, cash withdrawal and remittance) through Aadhaar Number Authentication. AEPS, a new age banking service has been approved by the Reserve Bank of India (RBI). The AEPS allows transactions using biometric authentication identify aadhaar number which is link with corresponding bank account and enables a person to carry out financial transaction on a micro-ATM provided by a banking correspondent. It is a unique and innovative system that allows trader/merchant to collect payment, operate as mini ATM for cash withdrawal, deposits, fund transfer and balance enquiry using Aadhaar Enabled Payment System. We provide you stander AEPS software with Integrated AEPS API solution.